$SMEFund Emission Schedule (10-Year Plan)

Total Initial Supply: 1,000,000,000 tokens

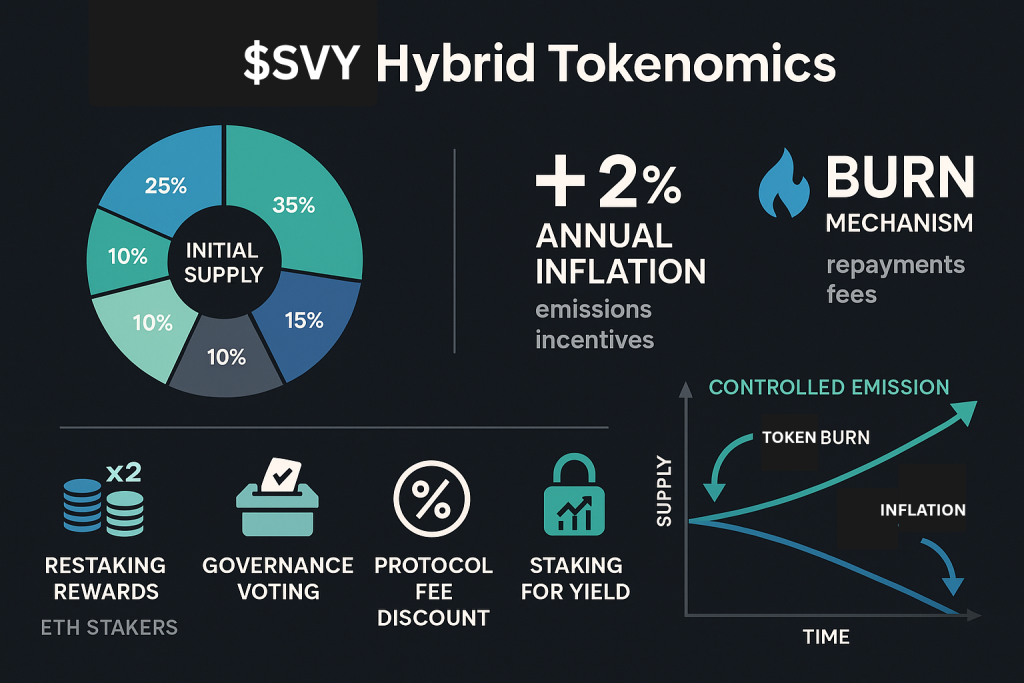

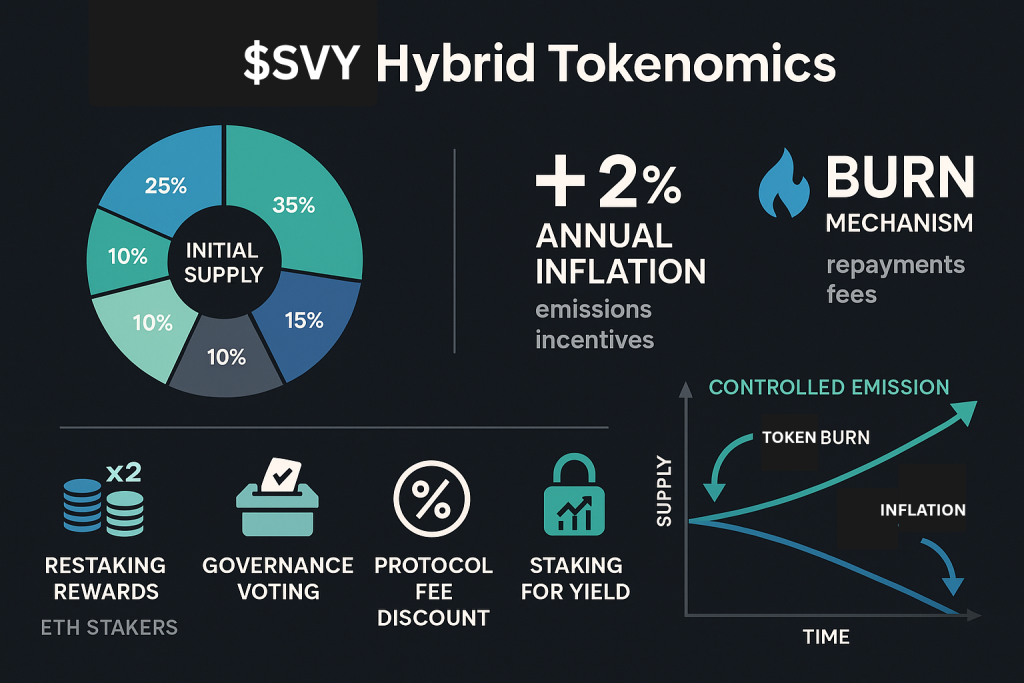

Annual Controlled Inflation Cap: 2% per year (starting in Phase 3)

Year-by-Year Breakdown (Years 1–5: Growth Focus)

| Year | Total New Tokens Minted | Purpose | Notes |

|---|

| 1 | 50,000,000 (5%) | Early staking, community, liquidity | High incentive year (MVP to launch) |

| 2 | 40,000,000 (4%) | Restaking rewards, validators, DAO | Begin EigenLayer integration |

| 3 | 30,000,000 (3%) | Ecosystem grants, SME rewards | SME onboarding expands |

| 4 | 20,000,000 (2%) | Maintained staking and restaking | Cap inflation to 2% annually |

| 5 | 20,000,000 (2%) | Reduced emissions, deflation ramps | Burns offset inflation |

Years 6–10: Stabilization Phase

| Year | Total New Tokens Minted | Purpose | Notes |

|---|

| 6–10 | 20,000,000 / year (2%) | Mostly for restaking rewards + DAO | Burns from fees/revenue aim to neutralize net supply growth |

Cumulative Supply Growth Estimate (w/ Cap)

| Year | Projected Total Supply |

|---|

| 1 | 1,050,000,000 |

| 2 | 1,090,000,000 |

| 3 | 1,120,000,000 |

| 4 | 1,140,000,000 |

| 5 | 1,160,000,000 |

| 10 | 1,260,000,000 (max) |

Actual circulating supply could be lower depending on burns from protocol revenues.

Token Lock Schedule for Fundraising

| Category | % of Total Supply | Vesting Schedule |

|---|

| Private Sale | 10% | 6-month cliff, 18-month linear vest |

| Strategic Partners | 5% | 1-year lock, 12-month vest |

| Public Sale (if any) | 3% | No cliff, 6-month linear vest |

| Team & Advisors | 10% | 12-month cliff, 24-month vesting |